Active central bank narrative construction in the service of their policy goals is a permanent change in our market dynamics. The introduction of such a powerful new weapon in the Fed’s policy arsenal can no more be removed than mustard gas or tanks could be removed from national arsenals after World War I. Market prices may be mean-reverting, but “innovation” in the service of social control never is.

What do the Missionaries get out of this? What’s our equivalent of wool and mutton? It’s low volatility. It’s the transformation of capital markets into a political utility, which is just about the greatest gift that status quo political interests can imagine. When Donald Trump and Steve Mnuchin talk about the stock market being their “report card”, they’re just saying out loud what every other Administration has known for years. Forget about markets, our entire political system relies on stocks going up. If stocks don’t go up, our public pension funds and social insurance programs are busted, driving our current levels of wealth inequality from ridiculously unbalanced to Louis XVI unbalanced. If stocks don’t go up, we don’t have new collateral for our new debt, and if we can’t keep borrowing and borrowing to fuel today’s consumption with tomorrow’s growth … well, that’s no fun, now is it?

The flip side to all this, of course, is that so long as stocks DO go up, nothing big is ever going to change, You say you want a revolution? You’re a MAGA guy and you want someone to drain the Swamp? You’re a Bernie Bro and you want the rich to “pay their fair share”? Well, good luck with any of that so long as stocks go up. It’s a very stable political equilibrium we have today, full of Sturm und Drang to provide a bit of amusement and distraction, but very stable for the Haves.

~ W. Ben Hunt, “Sheep Logic”

Rambus Chartology, Click Here

US Dollar Index

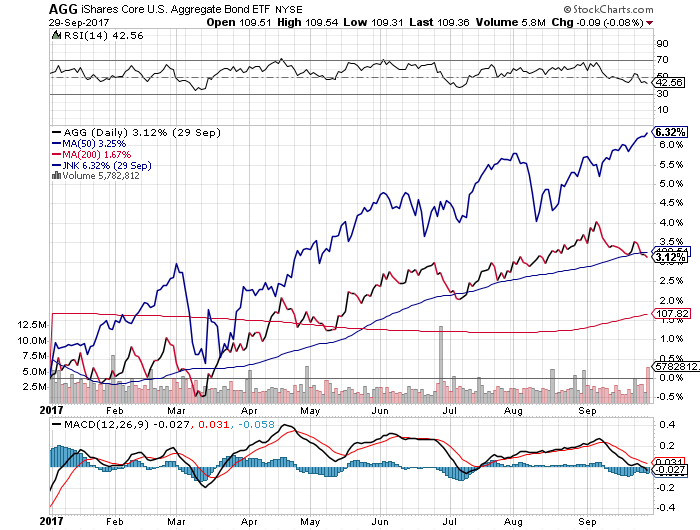

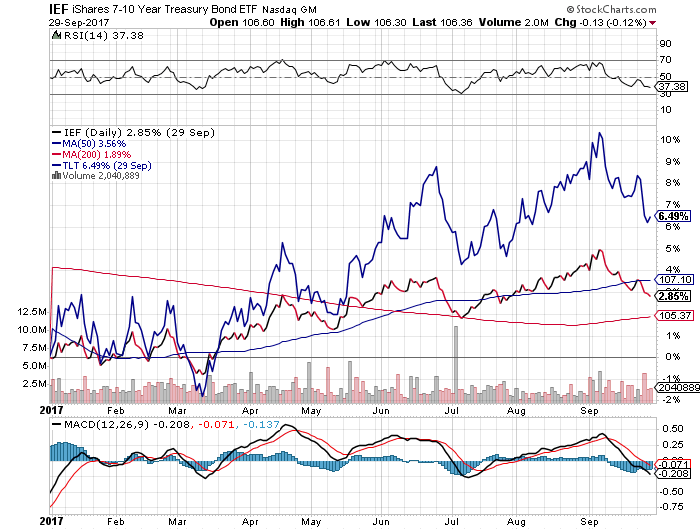

Fixed Income

US Bond Aggregate (AGG), High Yield Bond ETF (JNK)

5-7yr Treasury ETF (IEF), 20 yr. + Treasury ETF (TLT)

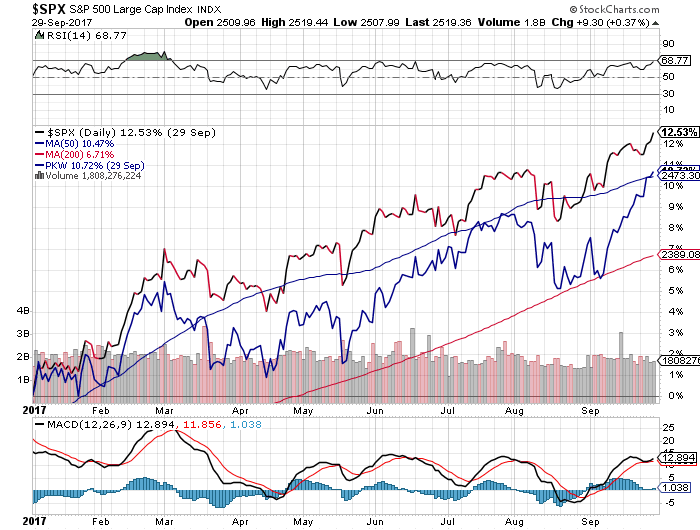

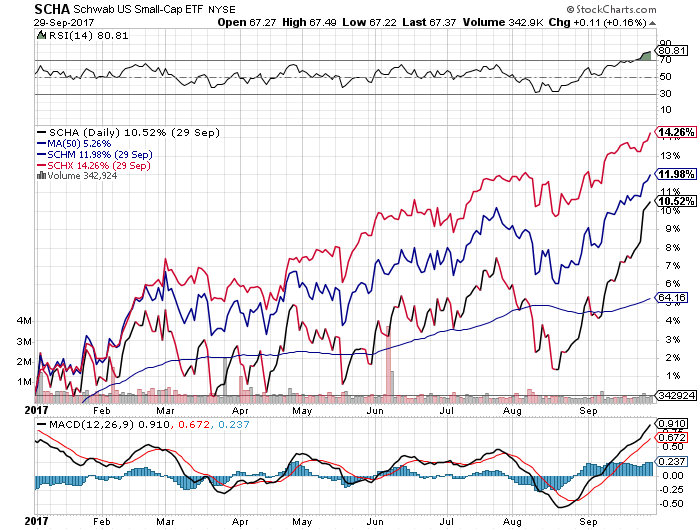

Equities

S&P Large Caps (SPX), Buybacks (PKW)

U.S. Small Caps (SCHA), U.S. Mid Caps (SCHM), U.S. Large Caps (SCHX)

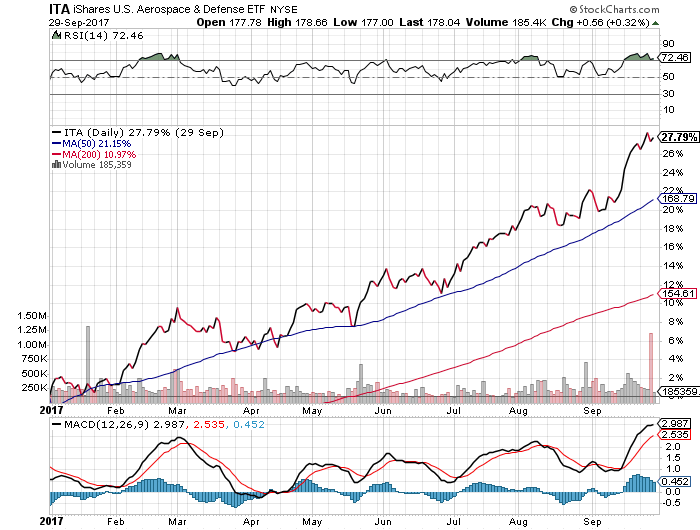

US Aerospace & Defense (ITA)

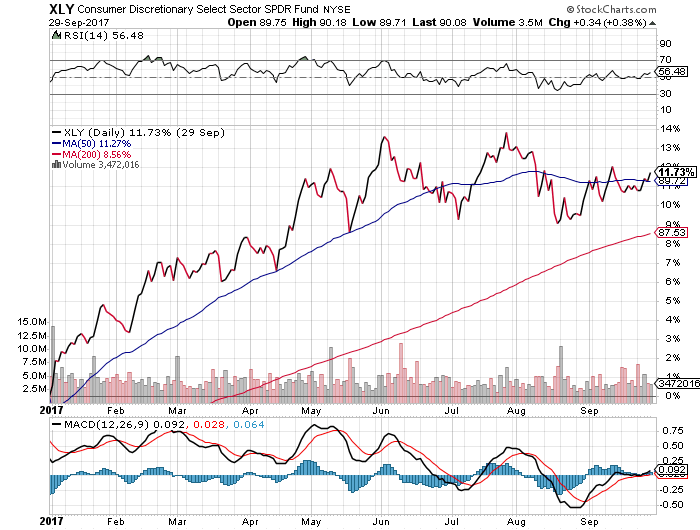

Consumer Discretionary (XLY)

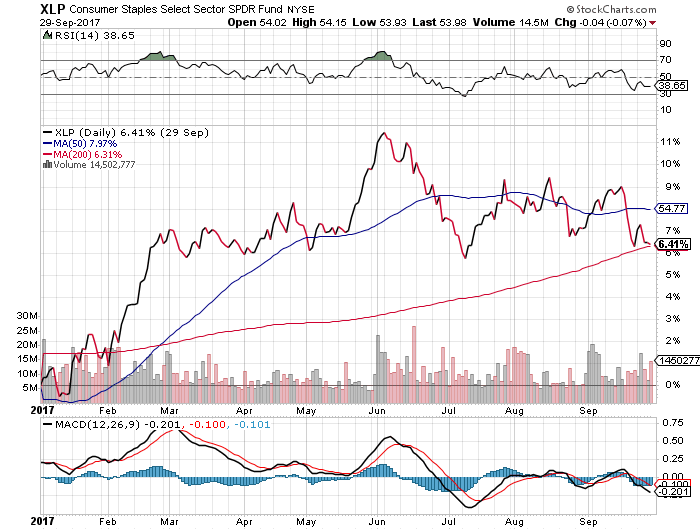

Consumer Staples (XLP)

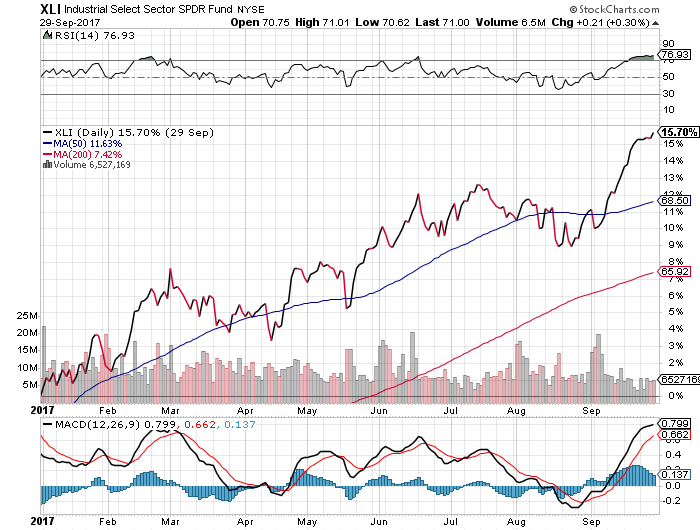

Industrial Select (XLI)

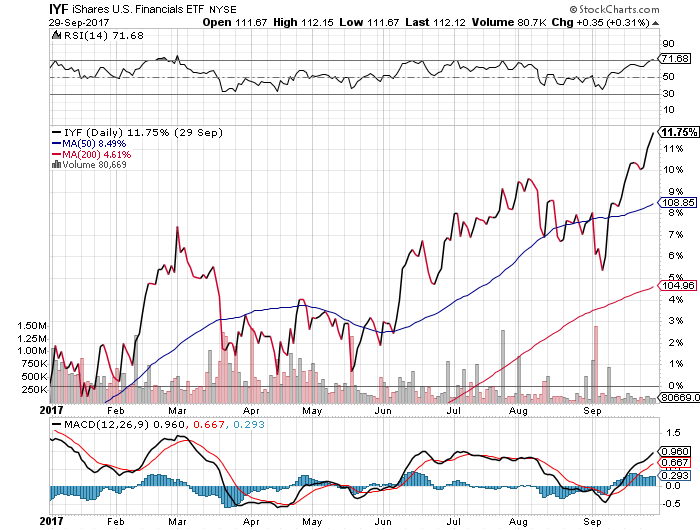

U.S. Financials ETF (IYF)

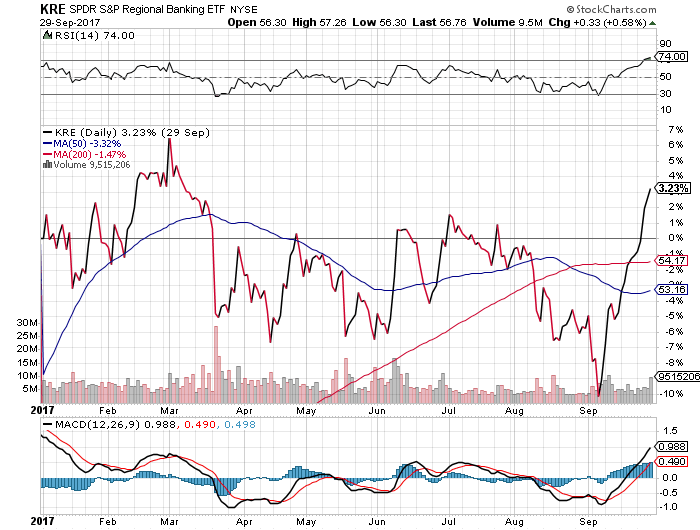

S&P Regional Banking (KRE)

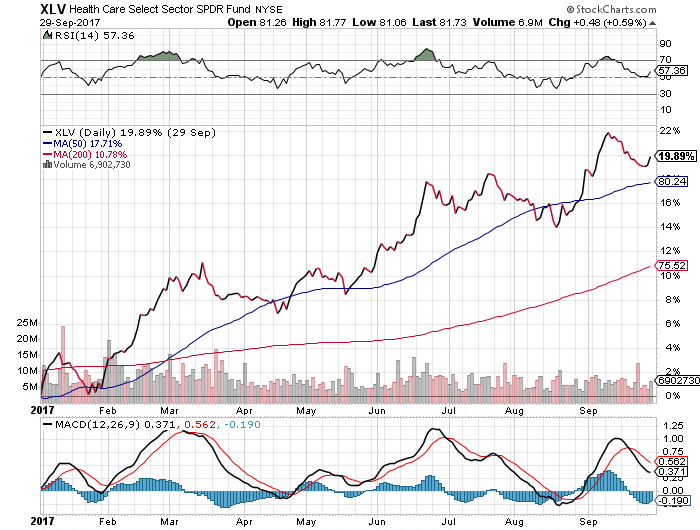

Health Care (XLV)

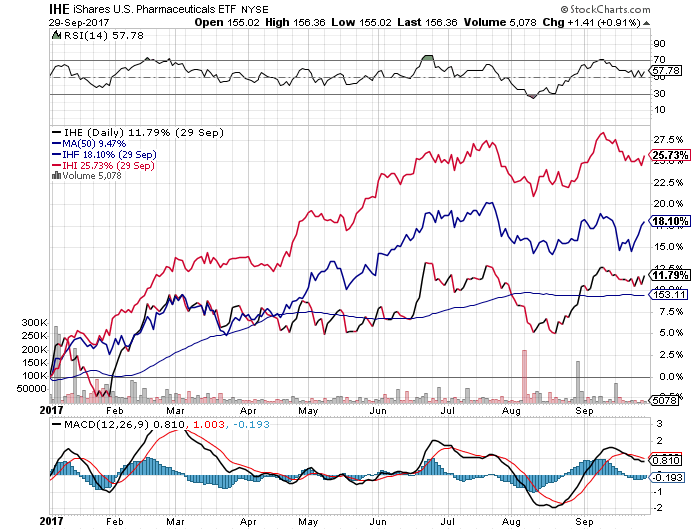

U.S. Pharmaceuticals

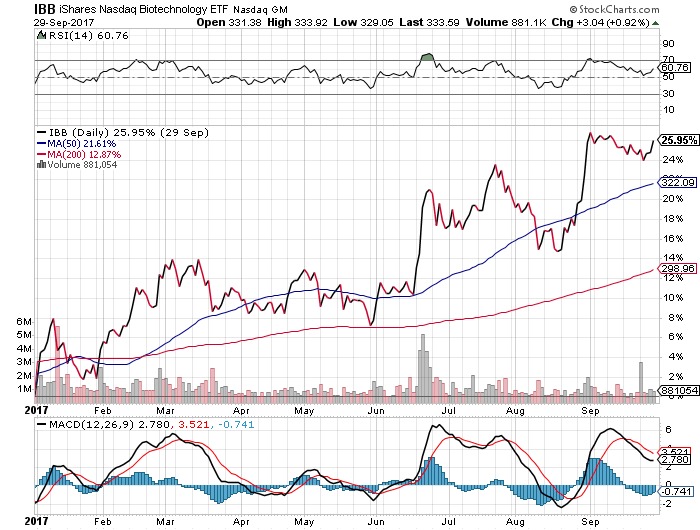

Biotech (IBB)

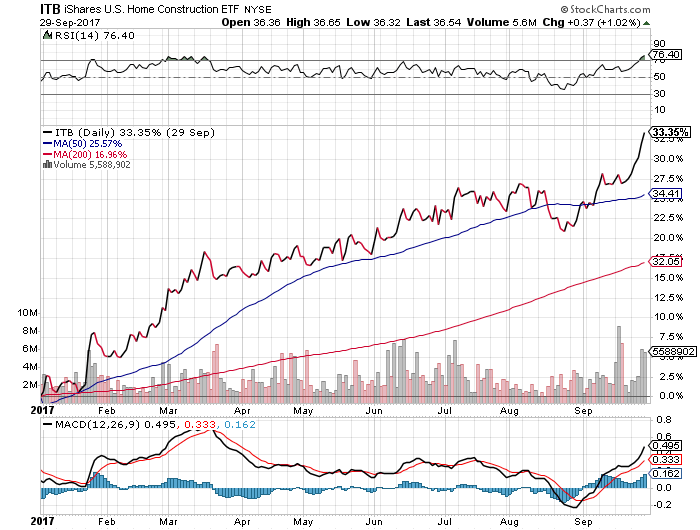

U.S. Home Construction (ITB)

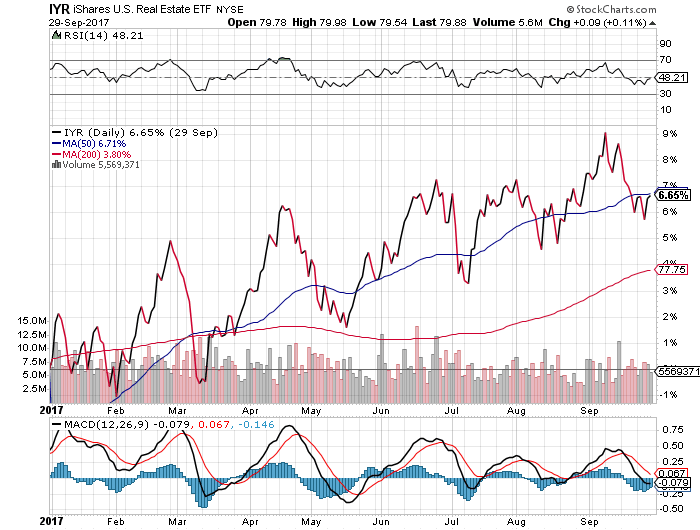

U.S. Real Estate (IYR)

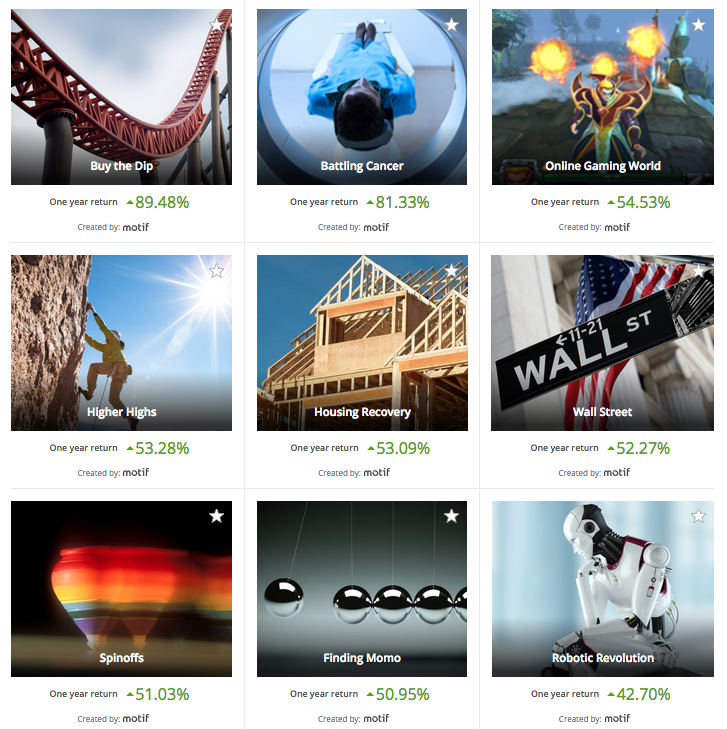

Motif Investing: Highest Earners (As of 10-10-17)

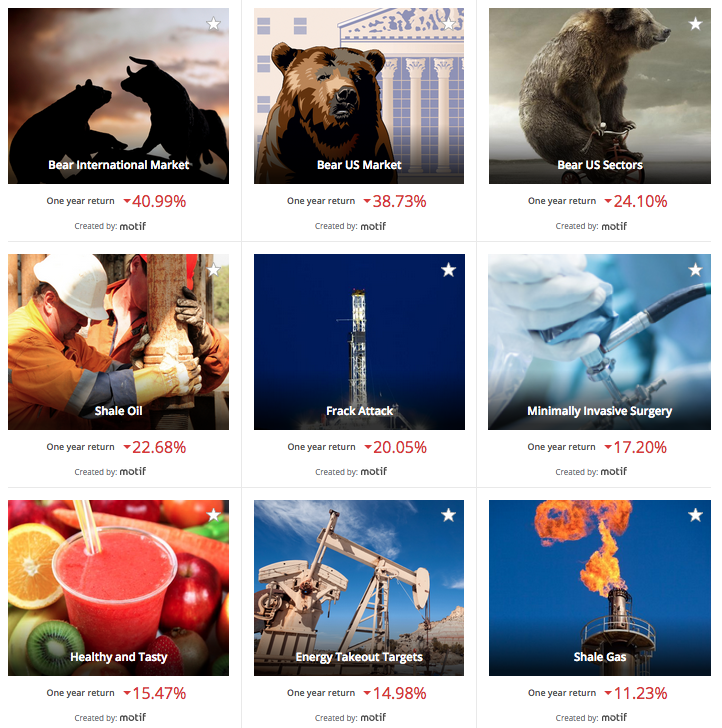

Motif Investing: Lowest Earners (As of 10-10-17)

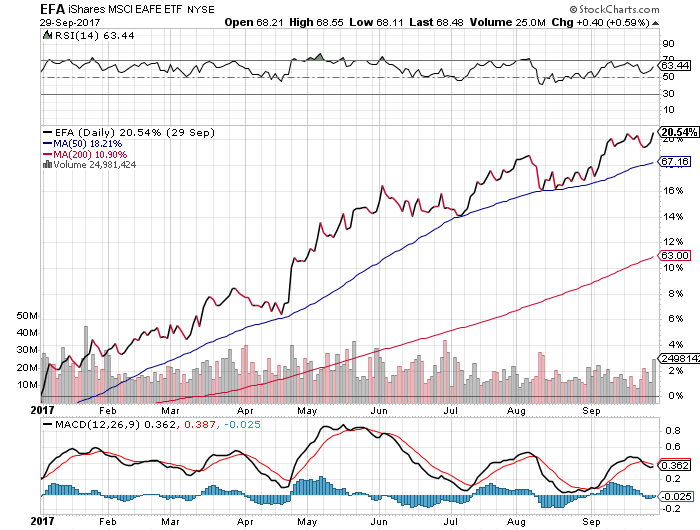

International

International Developed (EFA)

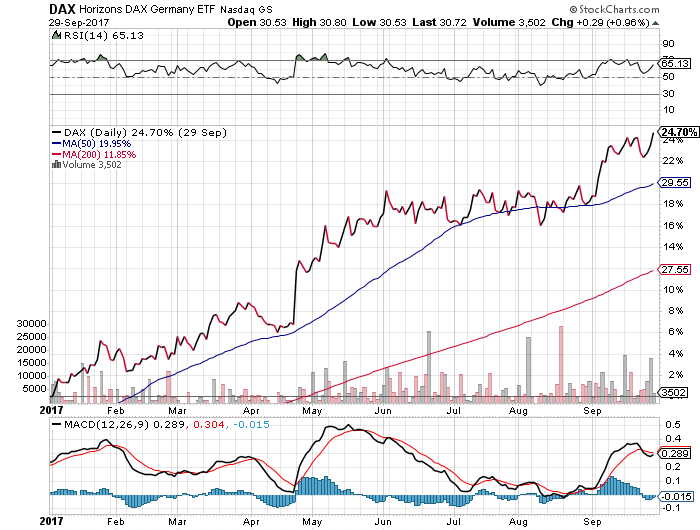

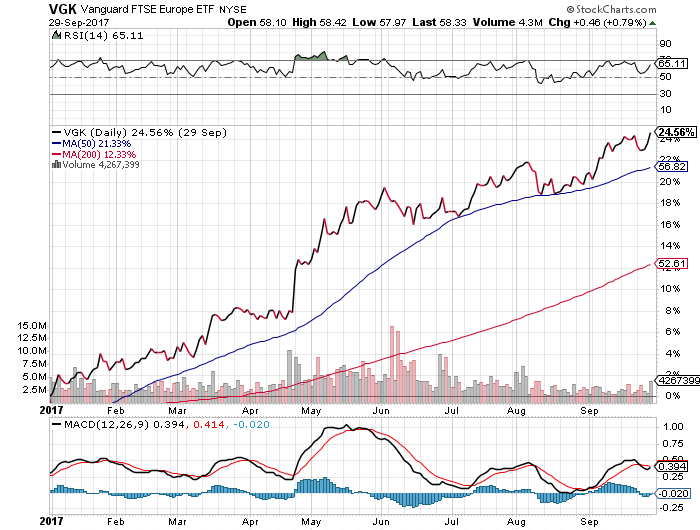

Europe

Germany (DAX)

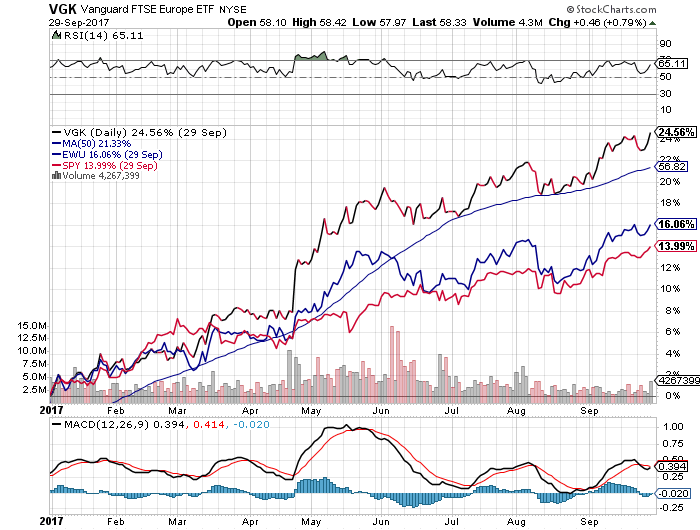

FTSE (VGK)

VGK (FTSE), EWU (UK), SPY (S&P)

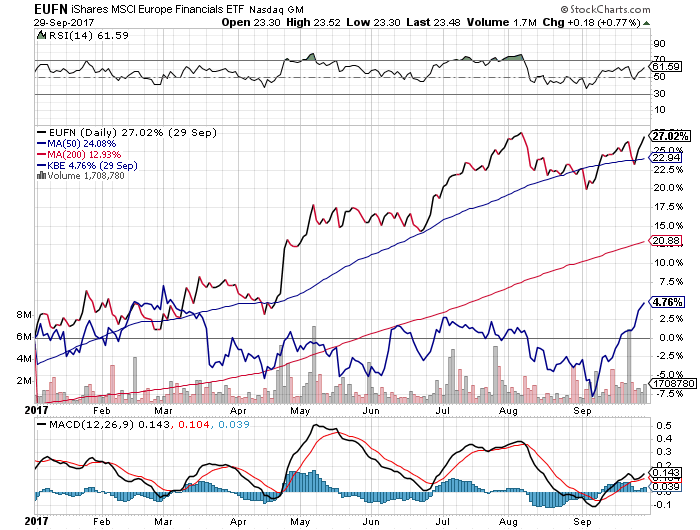

European Financials (EUFN), US Financials (KBE)

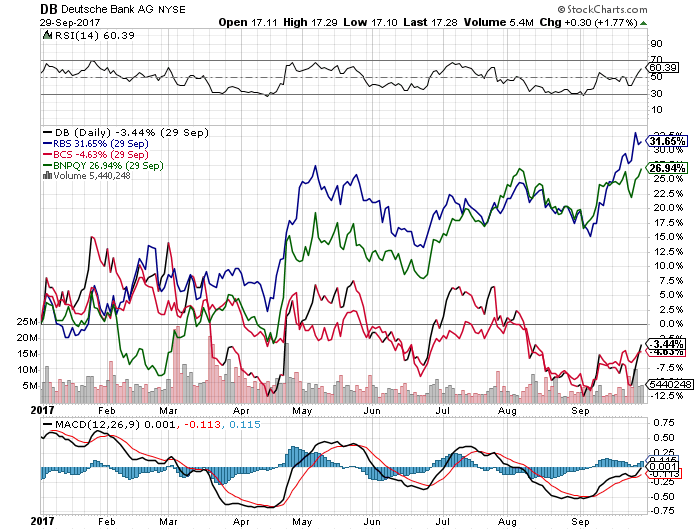

European Financials: Deutsche Bank (DB), Royal Bank of Scotland (RBS), Barclays (BCS), Paribas (BNPQY)

Asia

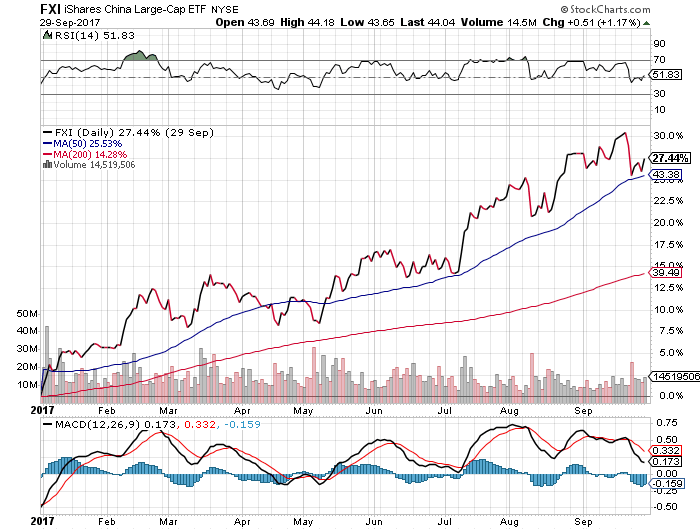

China Large Caps (FXI)

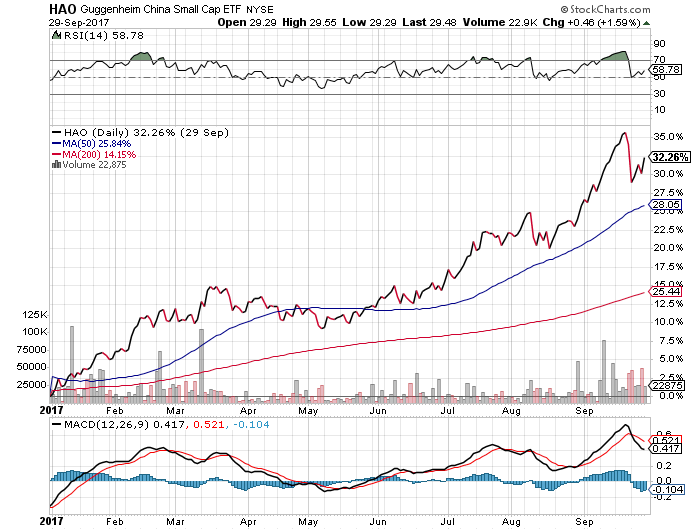

China Small Caps (HAO)

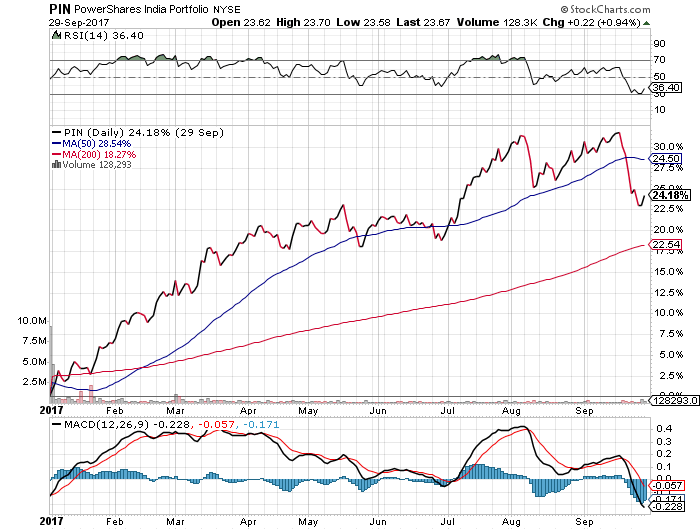

India (PIN)

Emerging Markets

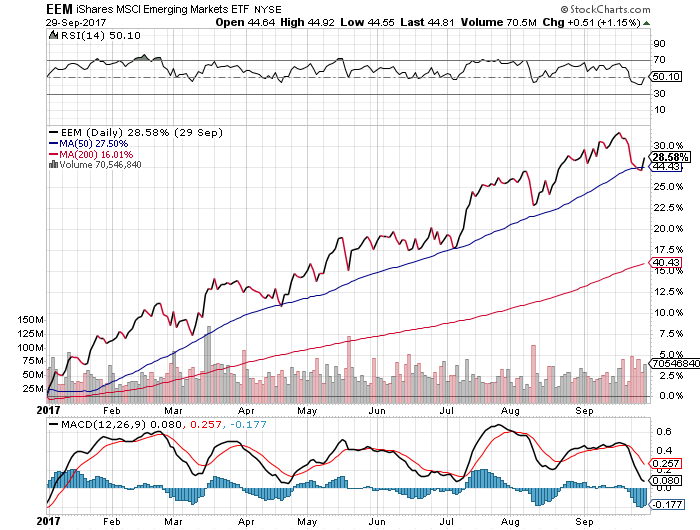

Emerging Markets (EEM)

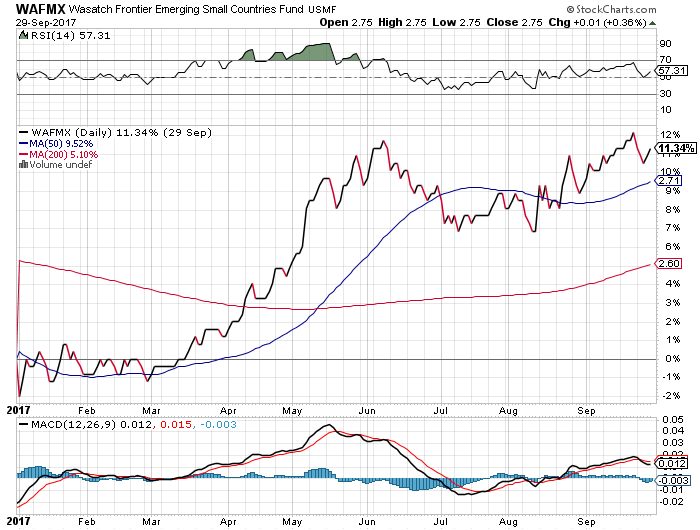

Frontier Markets (WAFMX)

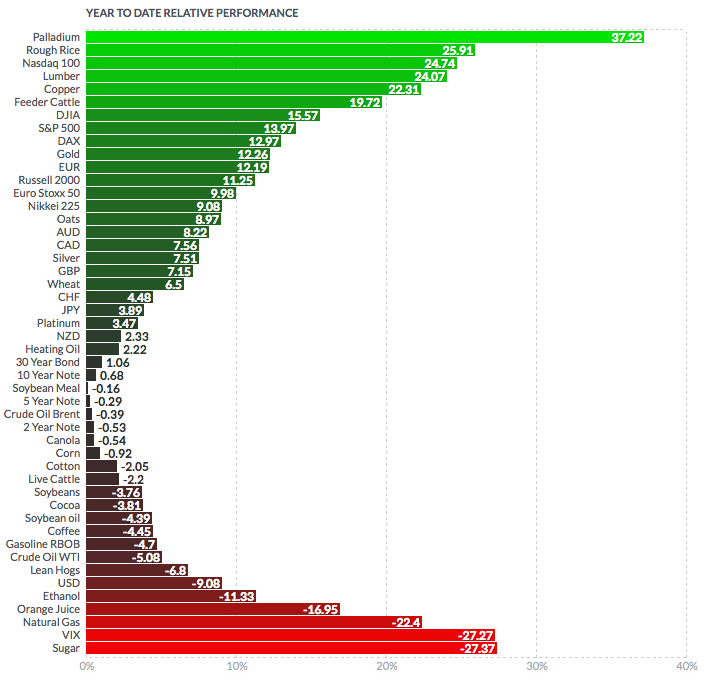

Commodities

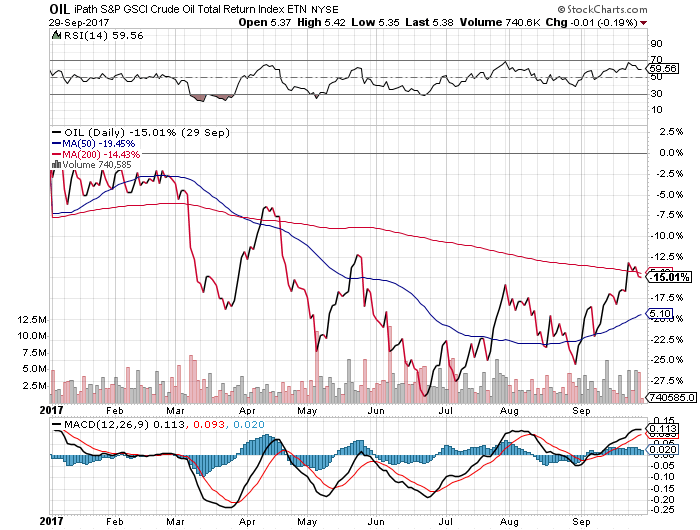

Crude Oil (OIL)

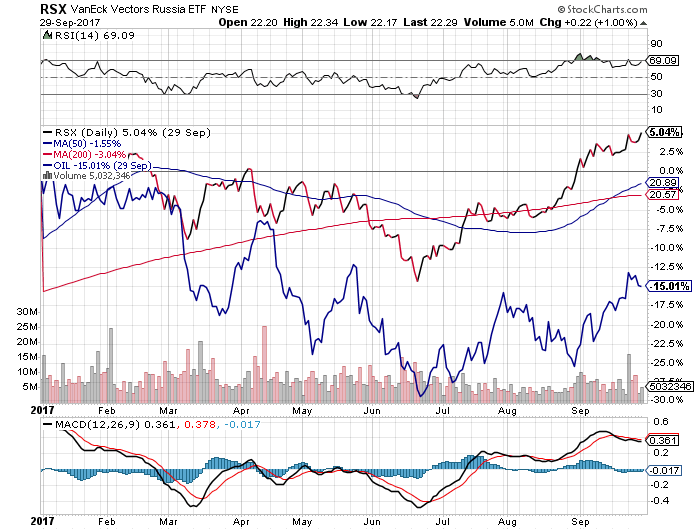

Russia (RSX), Crude Oil (OIL)

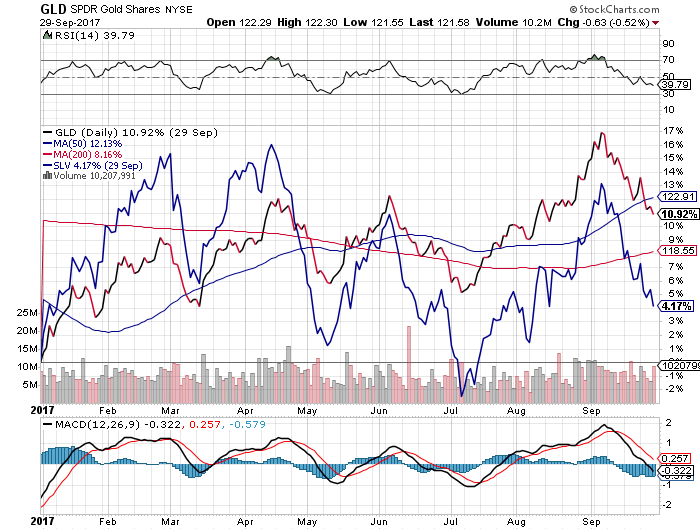

Gold (GLD), Silver (SLV)

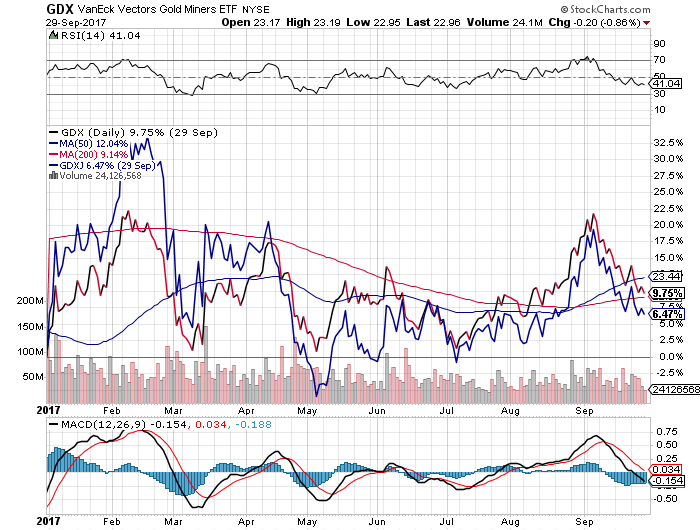

Mining (GDX), Junior Mining (GDXJ)

Commodities Index (CRB)

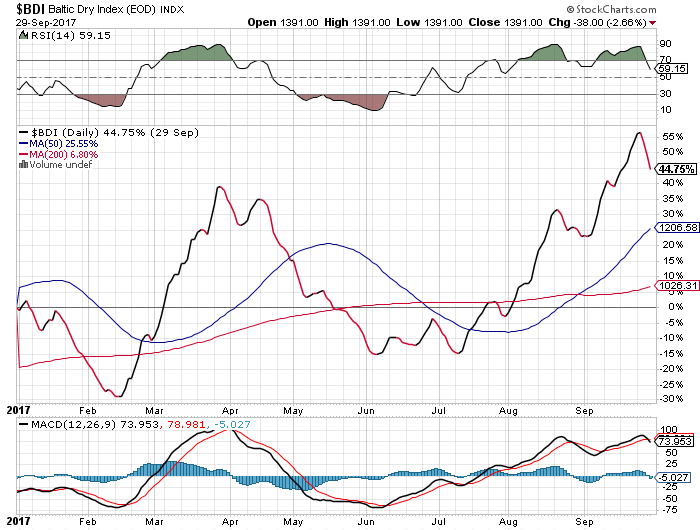

Baltic Dry Index

Related Resource: